|

|

Health

Savings Plans

Health Savings Accounts (HSA)

What is a Health Savings Account (HSA)?

A Health Savings Account (HSA) is designed to work with a high

deductible health plan and allows you to make pre-tax contributions to a

savings account. These funds can be used to pay for many qualified

medical expenses.

|

●

|

HSA s offer you a triple tax benefit:

Pre-Tax Contribution

Tax free payments for qualified medical expenses

Tax free interest on investment earnings |

|

● |

Use your HSA savings account to pay for your deductible

co-payments and any other qualified medical expenses.

To view eligible expenses and other resources go to:

Wex Inc. |

|

● |

If you don t use all your money

in your HSA savings account in a calendar year, the

remaining money automatically rolls over for use in

future years.

This money is always yours. |

|

● |

Think of an HSA like an Individual Retirement Account

(IRA) for medical expenses. |

|

● |

Once you have $1,000 in your HSA savings account, you

can decide how to invest and grow your money. Discovery

will provide you with many investment choices. |

|

● |

When you reach age 65, you can withdraw your money

without penalty and use your money for whatever you

want. |

|

● |

You can

manage your HSA account as simple as possible, by

downloading the Wex Inc. mobile app, available

on Apple or Android devices.

|

|

● |

With the Wex Inc. debit card, using your HSA

dollars has never been easier. You ll receive your one

card when you enroll, and you can request additional

cards for your spouse and dependents 18 years or older. |

|

● |

If you are covering your domestic partner on your high

deductible health plan, remember only you can contribute

and use the HSA money for your own qualified medical

expenses. The IRS does not recognize a domestic partner

as a dependent. So they cannot take advantage of the

tax savings on your account. Your domestic partner can

set up his/her own HSA with Wex Inc and use post tax

dollars that can be claimed as a savings in tax

returns. |

|

● |

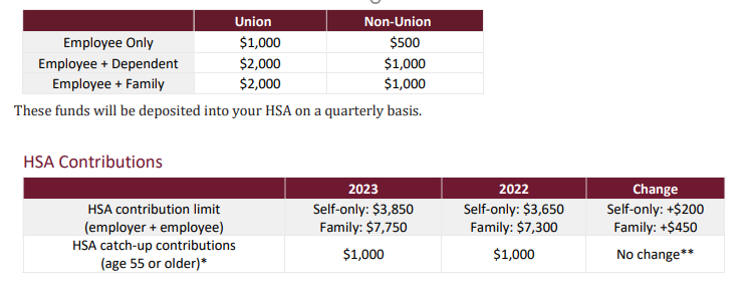

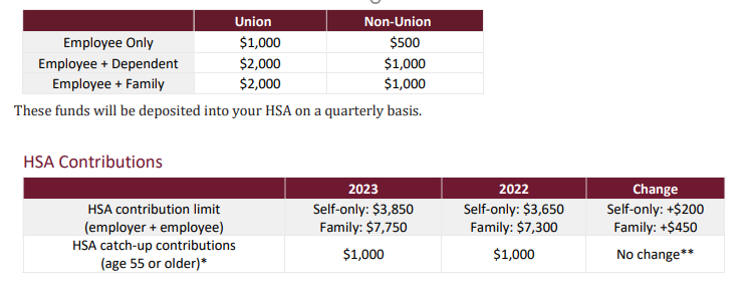

In 2023, if you participate in the high deductible plan

and open a HSA, Franklin Pierce University will

contribute to your savings. See chart below: |

| |

|

Limited Purpose Flexible

Spending Accounts

(LPFSA)

What is a Limited Purpose Flexible Spending

Account (LPFSA)?

Used in conjunction with both a High Deductible Health Plan and

an HSA, a LPFSA allows you to contribute additional pre-tax

dollars to use for dental and vision care expenses. This helps

you to maximize your pre-tax HSA contribution.

|

●

|

If you participate in the high deductible health plan

and have a HSA, you are can open only a LPFSA, not a

Health Care FSA. |

|

● |

In 2023 you can contribute up to $3,050 in your Limited

Purpose Health Care FSA. |

|

● |

You can submit dental and vision documentation within

minutes by using the Wex Inc. Benefits mobile app,

available on Apple and Android devices. The app is the

quickest and easiest method for filing claims and

submitting dental and vision documentation because it

lets you use your phone s camera to take pictures of

your dental and vision documents and upload them on the

spot.

|

|

● |

You can also submit dental and vision documentation

through your Wex Inc. website, by fax or regular mail.

To submit documentation through the Wex Inc website,

log in through the link below and follow the prompts.

You will see in the Receipt(s) Needed menu under the

Home tab.

(866)451-3399

https://www.wexinc.com/discovery-benefits/

|

|

|

|